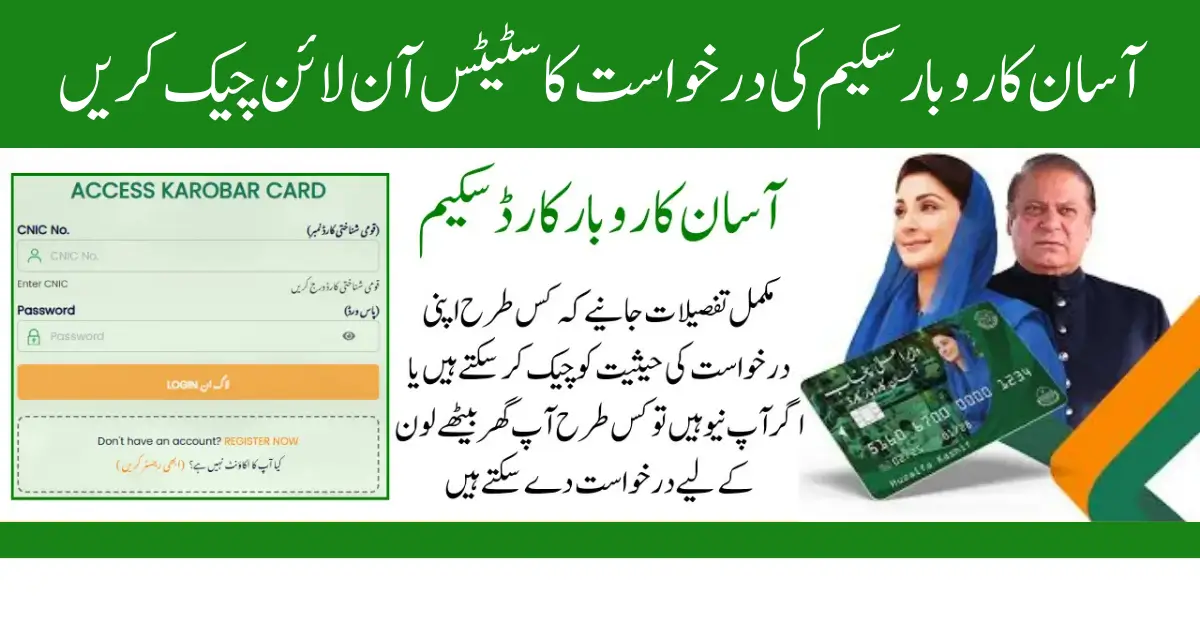

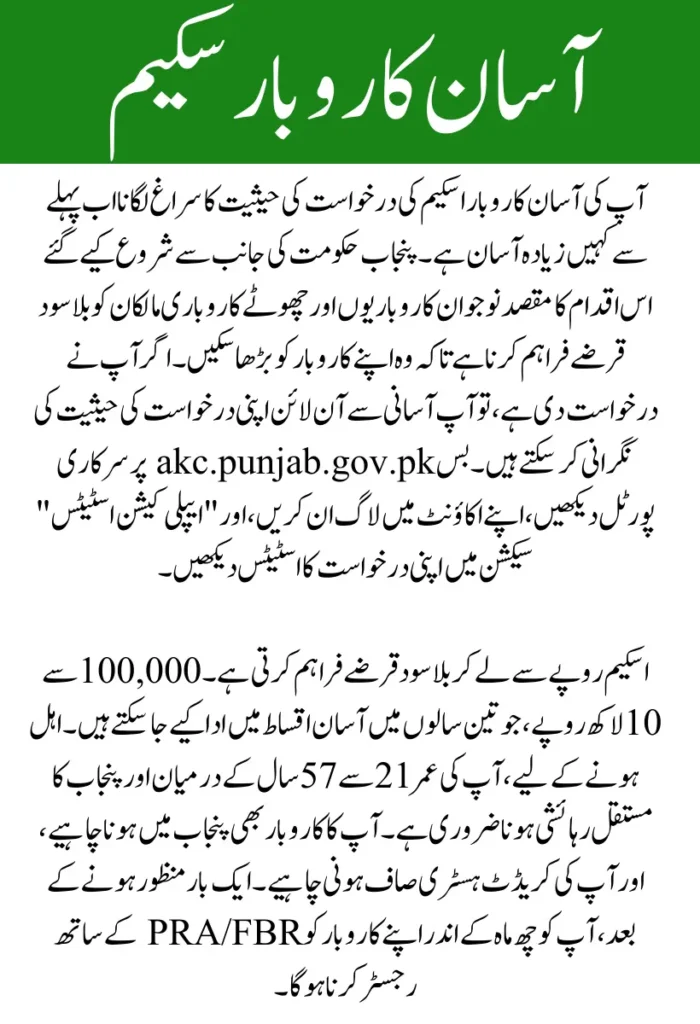

Tracking the status of your Asaan Karobar Scheme application is now simpler than ever. This initiative, launched by the Punjab government, aims to support young entrepreneurs and small business owners with interest-free loans to enhance their business operations. If you’ve applied, you can easily monitor your application status online. Simply visit the official portal at akc.punjab.gov.pk, log in to your account, and view your application’s status in the “Application Status” section.

The scheme offers interest-free loans ranging from Rs. 100,000 to Rs. 1 million, which can be repaid over three years in easy installments. To be eligible, you must be between the ages of 21 and 57 and a permanent resident of Punjab. Your business must also be located in Punjab, and you should have a clean credit history. Once approved, you must register your business with the PRA/FBR within six months.

If your application is rejected, you can reapply after addressing the issues. The approval process typically takes 4 to 6 weeks, so be sure to regularly check your application status. If additional necessary documents are requested, submit them promptly. Through this scheme, you not only have the opportunity to grow your business but also contribute to Punjab’s economic development.

For More Information: CM Punjab Bewa Sahara Card Online Registration

What is the Asaan Karobar Scheme?

The Asaan Karobar Scheme is a financial assistance program aimed at empowering the youth and small business owners in Punjab. It provides interest-free loans from Rs. 100,000 to Rs. 1 million to help individuals launch or expand their businesses. With flexible repayment options and an emphasis on digital transactions, this initiative offers a fantastic opportunity for those looking to achieve financial independence.

Benefits of the Asaan Karobar Scheme

Here’s why you should consider applying for the Asaan Karobar Scheme:

- Interest-Free Loans: No hidden charges or interest.

- Flexible Repayment: Pay the loan in easy installments over three years, with an additional three-month grace period.

- Business Flexibility: Use the funds for vendor payments, utility bills, taxes, and even cash withdrawals (up to 25% of the loan amount).

- Digital Convenience: Access funds through mobile apps and POS machines for smooth transactions.

Who Can Apply for the Asaan Karobar Scheme?

Before applying, ensure you meet these eligibility requirements:

- Age and Residency

- You must be between 20 and 57 years old.

- You should be a permanent resident of Punjab.

- Business Requirements

- Your business must be located in Punjab (whether new or existing).

- You must have a clean credit history with no overdue loans.

- Documentation

- A correct CNIC and a registered mobile number are required.

- Your business must be registered with PRA/FBR within six months after approval.

- Additional Conditions

- Only one application per person or business is allowed.

- A credit and psychometric assessment will be conducted.

For More Information: CM Punjab Laptop Scheme 2025 And How to Apply Online

How to Check the Status of Your Asaan Karobar Scheme Application

After applying, follow these steps to track your application:

- Visit akc.punjab.gov.pk to access the portal.

- Enter your CNIC and the password created during registration.

- Look for the “Application Status” option on your dashboard.

Here, you’ll find the following statuses:

- Pending (under review).

- Approved (ready for the next steps).

- Rejected (reasons provided).

- Requires Additional Documents (if any information is missing).

If your application is still pending or needs more documents, ensure you submit the requested information quickly. Keep checking for updates.

Common Reasons for Application Rejection

To avoid delays or rejections, be aware of these common mistakes:

- Incomplete Documentation: Missing CNIC copies or business details.

- Age or Residency Issues: Not meeting the required age or residency criteria.

- Poor Credit History: Existing overdue loans or payments.

- Failure to Register with PRA/FBR: Not completing the business registration within six months.

Tips for a Successful Asaan Karobar Scheme Application

Here are some tips to help increase your chances of success:

- Confirm Eligibility: Ensure you meet all the requirements before submitting your application.

- Prepare Your Documents: Gather your CNIC, business information, and other necessary paperwork in advance.

- Complete the PRA/FBR Registration: Do this promptly after loan approval.

- Monitor Your Application: Regularly check your status and follow up if necessary.

Conclusion

The Asaan Karobar Scheme is an excellent opportunity for Punjab’s youth and small business owners to fulfill their entrepreneurial dreams. With interest-free loans, flexible repayment plans, and an easy application process, this scheme makes it possible for many to start or expand their businesses.

If you meet the eligibility criteria, don’t hesitate. Apply now and take the first step toward financial independence. Visit the website at akc.punjab.gov.pk to get started.